RIYADH: A new premium residency visa has spurred home-ownership demand among Saudi-based expats, with 77 percent now looking to buy a property, a survey has revealed.

Global property consultancy Knight Frank surveyed 241 expatriates in Saudi Arabia, and discovered the primary motivation for real estate purchasing in the Kingdom, especially among millennials, is its perceived status as a good investment.

The desire for a close proximity to work and cultural or religious factors followed closely behind.

The survey findings also indicated a preference among expats for completed apartments over villas, with a potential demand of $863 million from the white-collar workforce for giga-project properties, alongside notable interest in branded residences among higher-income brackets.

The newly introduced premium residency visa linked to property ownership aims to meet some of the demand, however, the survey indicates that only 9 percent of respondents are willing to spend over SR3.5 million ($930,000), while the visa threshold is set at SR4 million.

Challenges arise as most respondents are comfortable allocating up to SR1.5 million for property in Saudi Arabia, with a substantial portion unwilling to exceed SR750,000.

Additionally, average property prices in Riyadh and Jeddah range between SR800,000 and SR2.7 million, posing further constraints for this group.

Survey findings also underscore a greater propensity for investment among millennials, with 22 percent allocating budgets exceeding SR2.5 million, while female expats show a higher-end budget allocation surpassing SR3.5 million.

The total combined budget among the 241 surveyed expats amounts to SR318.3 million.

The urgency of demand according to Knight Frank is not immediate, as survey results revealed that only 26 percent are looking to buy this year while 44 percent are aiming for a purchase within the next year to 24 months.

This cautious approach, as per the firm, could be attributed to the significant rise in house prices over the past three years, with Riyadh experiencing apartment prices at SR5,150 per sq. m. and villa prices at SR4,900 per sq. m.

This surge in demand is driven by the government’s goal of achieving a 70 percent home ownership rate by 2030, supported by mortgage programs. However, according to Knight Frank, the increased demand has also led to affordability challenges, resulting in a 16 percent decline in overall transactional activity last year.

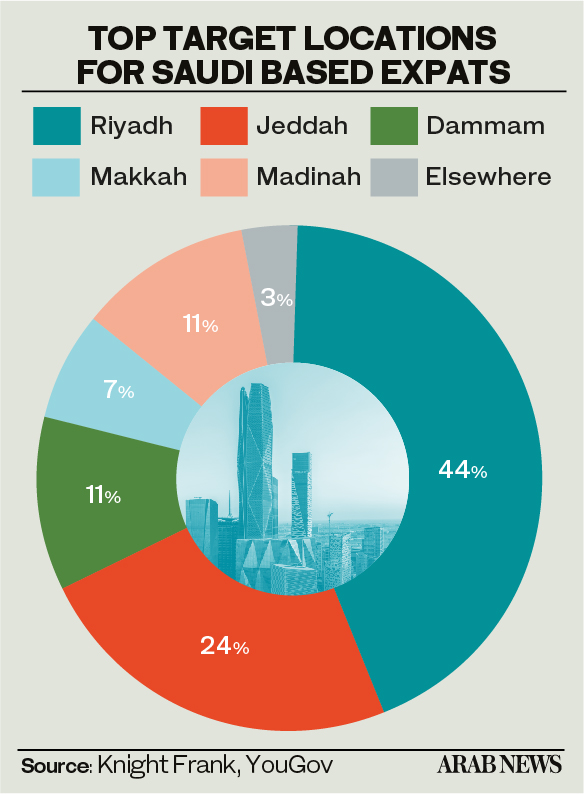

The firm emphasizes the substantial influence of the Kingdom’s Vision 2030 in making Riyadh the top choice for property purchases, particularly among millennials. This is attributed to the city’s appeal as an attractive destination for tourism and entertainment, thanks to the various entertainment seasons and a wide array of cultural, sporting, and arts events created by the authorities.

In the survey, Jeddah emerged as the second most desired city for property purchase, followed by Dammam and Madinah.

The survey revealed a notable shift in expat preferences, with 68 percent expressing a strong inclination towards owning an apartment rather than a villa. This preference is particularly strong among those aged 35-45 and 45-55, the firm added.

Additionally, the choice between apartments and villas seems to vary with income levels. For instance, 92 percent of expats earning more than SR40,000 per month prefer villas, while 60 percent of those earning between SR30,000 and SR40,000 per month lean towards townhouses.

The fact that high earners are prepared to spend more on giga-project homes will be welcome news for developers, but the key will be to offer distinctive community features and amenities that go above and beyond.

Mohamad Itani, Knight Frank partner and head of residential project sales and marketing

The shift from villas to apartments for the majority of respondents is likely influenced by factors such as the higher cost associated with villas, affordability considerations, and possibly differing cultural preferences compared to Saudi nationals, the firm said.

The appeal of apartments is further highlighted by the fact that 53 percent of surveyed expats expressed a preference for owning a two or three bedroom apartment. This inclination is likely due to the smaller family sizes typically found among expats compared to Saudi nationals.

Knight Frank showed that 63 percent of respondents prefer to buy completed properties, while 26 percent are interested in off-plan purchases. This preference may have implications for developers according to the firm as they navigate Saudi Arabia’s 660,000 residential unit pipeline in the next six years.

Expat property buyers are willing to pay an average annual service charge rate of 5.9 percent of the property value.

According to Knight Frank, the rising demand for residential communities is driven by an increasing number of Western expatriates seeking a lifestyle that matches their expectations.

These gated communities, known for their amenities such as swimming pools, cafes, and fitness centers, offer a high standard of living, the firm noted.

Western compounds are characterized by their larger size, superior services, extensive amenities, and heightened security, typically catering to Western expats.

In contrast, non-Western compounds are smaller, with fewer facilities, and primarily occupied by Arab and Asian expats.

In Knight Frank’s survey of expats, a notable appeal was found for residential compounds, with 75 percent expressing interest, a figure that rises to 77 percent among millennials.

This interest, as per the firm, correlates closely with income, with the percentage climbing to 94 percent among those earning over SR40,000 monthly. Among expats under 35, this percentage rises further to 85 percent, with females showing particularly heightened interest compared to males.

According to the report, Riyadh has 131 residential compounds, with 38 categorized as Western and 93 as non-Western. Jeddah, on the other hand, has 98 gated compounds, including 19 Western and 79 non-Western.

The top three sought-after features in a residential community include onsite essentials such as supermarkets and clinics, management services including maintenance and security, and transportation facilities like bike storage and parking.

According to Knight Frank, NEOM emerged as the most sought-after giga-project among expats. However, discrepancies between their budgets and the project’s expected prices posed a limitation. Nonetheless, a considerable proportion of respondents, particularly millennials, expressed willingness to reconsider their budget to afford a residence in NEOM.

Mohamad Itani, Knight Frank partner and head of residential project sales and marketing, said: “High earning expats are eager to own property in the Kingdom’s giga-projects and the fact that high earners are prepared to spend more on giga-project homes will be welcome news for developers, but the key will be to offer distinctive community features and amenities that go above and beyond.”

The average budget for giga-projects among expats stands at SR2.7 million, surpassing the SR1.7 million average elsewhere in the Kingdom. This translates to a total spending power of approximately $152 million among Saudi surveyed expats. When projected to the Kingdom’s 1.2 million white-collar workforce, the potential dry powder capital is estimated to be $863 million.

The top pull factors for owning a home in any of the giga-projects, as indicated by respondents, were parks and green spaces and family entertainment. Following closely were investing in Saudi Arabia’s future Vision 2030, world-class entertainment and theme parks, and climate. These factors outline the key considerations expats have regarding giga-project homeownership.

However, expats emphasized that local bank financing options would significantly influence their decision, especially given the discrepancy revealed between expats’ budgets and the current market pricing for branded residences, which surpasses what they can afford.

According to Knight Frank, the rising popularity of branded residences in Saudi Arabia presents a lucrative opportunity for developers, considering the strong demand from both global high net worth individuals and expats.

With 55 percent of expats willing to spend up to SR1.5 million, there is potential for developers to introduce branded products into their residential portfolios.

Offering timeshare options and collaborating with local banks to provide mortgages could further stimulate demand, the firm concluded.