RIYADH: Private-public partnerships have become a cornerstone for attracting substantial investment to Saudi Arabia’s real estate market over the past five years, an expert has told an industry forum.

Amid Saudi Arabia’s drive to bolster the private sector and foster sustainable partnerships for development, the role of PPPs in spurring economic growth and innovation is now more critical than ever, delegates at the 15th Real Estate Development Summit Saudi Arabia - Europe edition were told.

Saudi real estate projects headlined the event held in Palma de Mallorca, Spain and hosted by GBB Venture. This gathering featured over 100 companies and connected decision-makers from major Saudi projects with global suppliers.

It also showcased the Kingdom’s rapid real estate advancements, driven by ambitious urban developments and substantial infrastructure investments, emphasizing sustainability and innovation.

Speaking at the event, Elias Abou Samra, CEO of Rafal Real Estate, said: “We’ve seen good traction on PPPs. With private-public partnerships, you have guaranteed offtake. So most of the investments that came into the country were based on this.”

In a panel discussion titled “In Conversation with a Chief Challenger,” Abou Samra introduced a classification system for PPPs in Saudi Arabia – structured and unstructured.

“It’s a definition that I came up with, but it helps me understand the landscape of opportunities,” he said.

Structured PPPs encompass projects under the National Center for Privatization, which are highly organized and regulated. In contrast, unstructured PPPs involve mega projects like NEOM and Red Sea, characterized by joint ventures between public entities and private investors.

The NCP, is one of the executive programs launched by the Council of Economic and Development Affairs to achieve the objectives of Vision 2030.

The program seeks to support the development of the national economy, and enhance the role of the private sector as well as strengthen the government’s focus on its legislative and regulatory role and seek to attract local and foreign direct investments.

During the discussion, Abou Samra unveiled a wealth of opportunities awaiting investors in the Saudi real estate market, highlighting the $1.5 trillion figure mentioned in a recent report by the US-based global real estate services company JLL, which details the pipeline for onward projects in the Kingdom.

“It will be good to segment this $1.5 trillion to understand the landscape of opportunities in the market out of the $1.5 trillion,” said Abou Samra.

“I believe $80 to $90 billion have already been awarded. So that means there’s 15 times growth in terms of projects to be done over the next seven, eight, maybe 10 years,” he added.

The CEO was candid about the challenges faced by mega projects, acknowledging that they require time and often encounter issues. “It’s no secret that these projects can be stretched, but the relevance of these figures is to highlight the scale of opportunities. While the Saudi government may not invest the remaining balance of $1.5 trillion in the near term, there is notable traction from foreign direct investments.”

Regional investors have already shown significant interest, a development Abou Samra viewed as a healthy sign that will drive further foreign direct investment from both Western and Eastern markets.

“(They) understand the intricacies of investing in Saudi Arabia, creating a ripple effect that fosters more substantial international investment,” he explained.

The real estate market in Saudi Arabia is transitioning from traditional infrastructure projects to more sophisticated superstructures and operational activities. This transformation is poised to accelerate, particularly as most infrastructure works are already well underway. Abou Samra emphasized that this progress is promising for industries such as construction, lifestyle, tourism, and interior design.

Several initiatives are currently underway, including the headquarters group, which has seen a growing number of regional HQs moving to Riyadh.

“As of my last check, 225 companies have relocated their regional headquarters to Riyadh. This demonstrates the leadership’s commitment to interdisciplinary development and value creation,” Abou Samra remarked.

More than 120 international firms received licenses to relocate their regional headquarters to Saudi Arabia during the first quarter of 2024, representing a 477 percent year-on-year increase.

In its quarterly report, the Kingdom’s Ministry of Investment revealed 127 permits issued in the first three months of the year, underscoring the nation’s attractive and favorable business environment.

Speaking on the demand for residency in Saudi Arabia, the CEO emphasized that it remains robust, driven primarily by local residents and increasingly by expatriates who have made the Kingdom their home.

“I’ve launched the project since the beginning of this year, and almost 15 percent of the buyers are expats that are residents. Some of them have been residing in Saudi for 10 or more years, so they call it home. But until very recently, they were not actually buying a house,” said Rafal’s head.

This demand is primarily from Arabs and Southeast Asians, with potential growth in Western expatriates as community-driven projects like Dirriyah take shape, he explained.

Saudi Arabia launched the premium visa residency option in 2019, aimed to allow eligible foreigners to live in the Kingdom and receive benefits such as exemption from paying expat and dependents fees, visa-free international travel, and the right to own real estate and run a business without requiring a sponsor.

Abou Samra also discussed the burgeoning mortgage industry in Saudi Arabia, which is catching up on lost years of low uptake. The Saudi Real Estate Refinance Co., established by the Minister of Housing, aims to securitize and syndicate mortgage portfolios, creating liquidity in the market.

This initiative is likened to the establishment of Freddie Mac and Fannie Mae in the US, according to the CEO.

Alternative strategies, such as land deals with extended payment terms, are being employed to decouple from debt markets amid anticipated turbulence. “We just won a project that’s a couple billion riyals in value, but we could start with 150 million riyals of equity, and this is without debt,” Abou Samra shared.

He concluded with a call to action for vendors and suppliers, emphasizing the importance of localization in the supply chain. “Localization is key. I know we’re speaking to a crowd that’s mostly vendors and suppliers from all over the world, but my advice would be, find ways to localize your products,” he urged.

The insights provided by Abou Samra underscored the dynamic and evolving nature of the Saudi real estate market, presenting a wealth of opportunities for investors and stakeholders.

Saudi Arabia’s real estate sector is poised for substantial growth, with projections reaching $69.51 billion in 2024 and anticipated to surge to $101.62 billion by 2029. This expansion aligns closely with the Kingdom’s Vision 2030, focusing prominently on housing, tourism, and commercial development.

Chief Operating Officer of Armada Casa, Wassim Hamdanieh. Supplied

Speaking to Arab News on the sidelines of the event Wassim Hamdanieh, chief operating officer of high-end construction material supplier Armada Casa, said his firm plans to establish key partnerships to expand its premium construction materials portfolio.

“With Vision 2030 driving rapid growth, our focus is on meticulous, detail-oriented developments that align with the country’s urban and sustainability goals, positioning us to shape the future of Saudi Arabia’s property landscape with unparalleled quality and innovation,” he said.

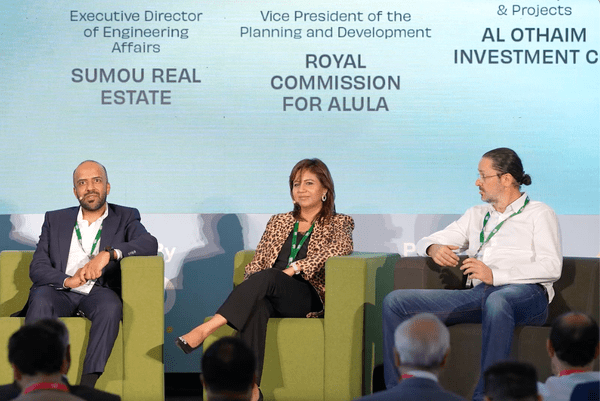

In another panel discussion, titled “Setting Saudi Above the Competing Boundaries,” Navdeep Hanjra, vice president of planning and development at the Royal Commission for AlUla, highlighted the vast potential of the region.

“AlUla spans 22,000 sq. km., nearly the size of Belgium, and boasts stunning landscapes and significant nature reserves. Its master plans showcase its uniqueness and diversity,” she said.

Hanjra elaborated on the five master plans, emphasizing the “Journey Through Time,” which guides visitors from the ancient Nabataean era to Hegra, Saudi Arabia’s first UNESCO World Heritage site.

The “Path to Prosperity” master plan aims to grow the current population from 44,000 to 122,000, transforming AlUla into a sustainable city that balances tourism and community development.

Navdeep Hanjra, vice president of planning and development at the Royal Commission for AlUla. Screenshot

The vice president emphasized that 70 percent of AlUla’s land is dedicated to nature reserves, ensuring the preservation and regeneration of its historic landscapes.

In response to whether AlUla would remain a limited tourist destination or open up further, Hanjra explained that a structured framework plan, developed five years ago, guides the region’s development.

This plan includes clear urban development boundaries, visitor targets, and 12 guiding principles focused on cultural and natural heritage, sustainability, and socio-economic factors.

These principles aim to support and retain the existing community while promoting sustainable development and re-naturalizing the landscape for future generations.