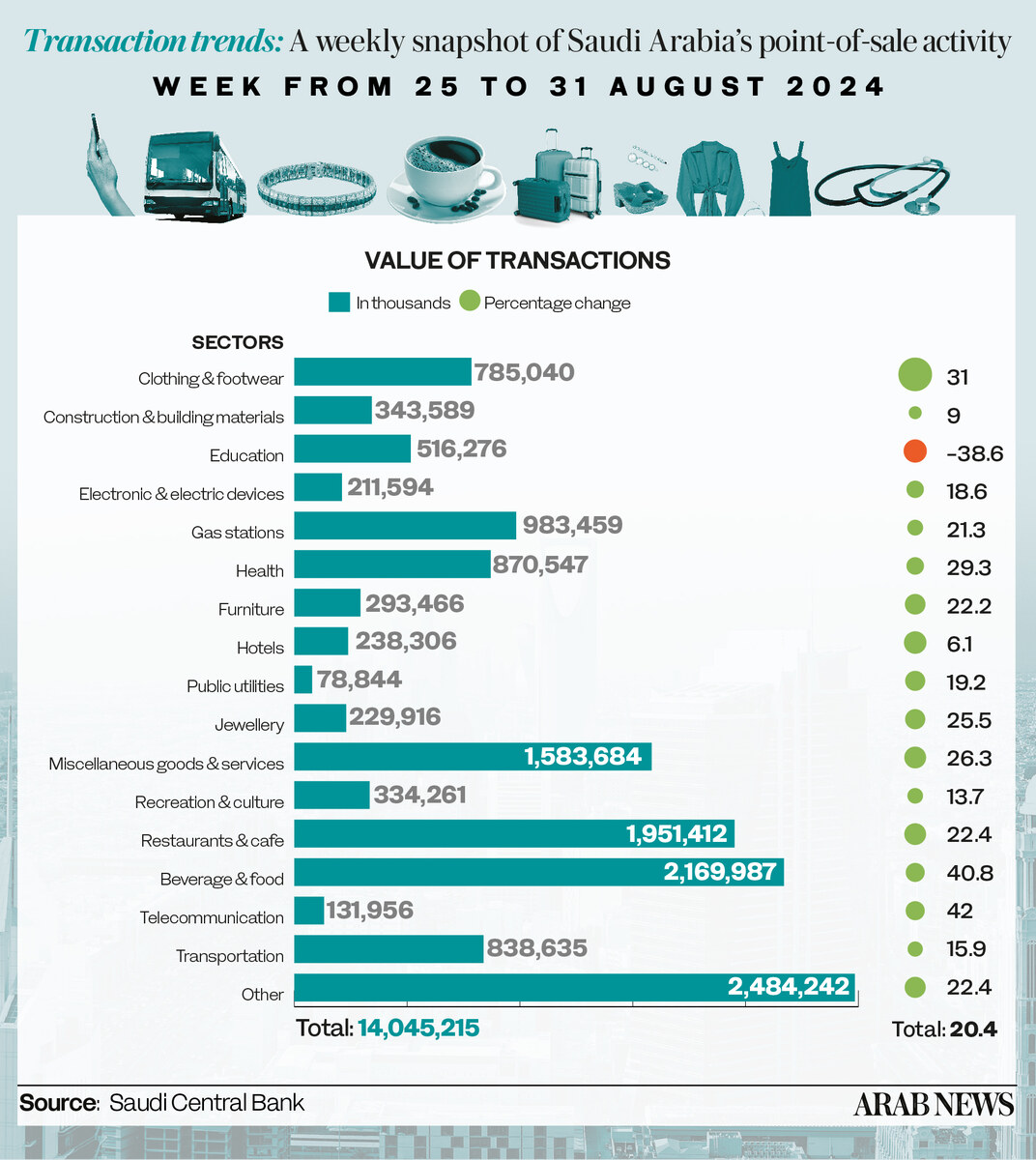

RIYADH: Saudi Arabia’s point-of-sale transactions registered a weekly increase of 20.4 percent between Aug. 25 and 31, with the telecommunication sector leading the growth.

The Saudi Central Bank, also known as SAMA, recorded SR14 billion ($3.7 billion) in transactions over the seven-day period, with the telecoms industry posting the highest sectoral increase at 42 percent to reach SR131.9 million.

The figures revealed the education sector saw the only decline, dropping 38.6 percent to SR516.2 million. This was the second decrease in a row for the sphere after surging for four straight weeks, coinciding with the start of the academic year on Aug. 18.

Spending on food and beverages recorded the second largest surge, with a 40.8 percent positive change, reaching SR2.16 billion.

Expenditure in clothing and footwear came in third place, recording a 31 percent increase reaching SR785 million during this period.

Restaurants and cafes accounted for the second-largest POS transaction value, with SR1.96 billion. Miscellaneous goods and services followed at SR1.58 billion.

Spending in the leading three categories accounted for 40.62 percent or SR5.7 billion of the week’s total value.

At 6.1 percent, the smallest increase occurred in hotel spending, boosting total payments to SR238.3 million. Expenditures on construction and building materials came second, surging 9 percent to SR343.5 million. In the third place, spending on recreation and culture increased by 13.7 percent to SR334.2 million.

Geographically, Riyadh dominated POS transactions, representing 34 percent of the total, with expenses in the capital reaching SR4.77 billion — a 14.3 percent increase from the previous week.

Jeddah followed with a 13.6 percent surge to SR1.92 billion, accounting for 13.6 percent of the total, and Dammam came in third at SR691 million, up 17.1 percent.

Hail experienced the most significant rise in spending, increasing 37.9 percent to SR231.8 million. Tabuk and Buraidah also witnessed upticks, with expenditure surging 37.3 percent and 22.9 percent to SR294.1 million and SR335.5 million, respectively.

In terms of the number of transactions, Hail recorded the highest increase at 24.9 percent, reaching 4 million transactions, followed by Tabuk with a 21.4 percent increase, achieving 4.9 million transactions.