CAIRO: Early-stage startups across the Middle East and North Africa region secure investments to drive innovation in sectors such as logistics, fintech, and climate tech.

Saudi-based Nama Ventures co-led Egypt’s Nowlun $1.7 million seed funding round along with venture capital firm A15.

The round also saw participation from Sanabil 500 Global and other angel investors.

Founded in 2021 by Moataz Khamis, Ahmed Emara, and Mahmoud Khaled, Nowlun’s platform provides businesses with access to real-time pricing across major shipping lines, enabling them to make faster and more informed decisions.

The company plans to utilize the raised capital for expansion and the development of its technology.

Mohammed Al-Zubi, founder of Nama Ventures, and Bassem Raafat, principal at A15, lauded the company’s mission and strategy.

Naif Al Rajhi acquires stake in Jordan’s Mawdoo3

Saudi investment firm Naif Al Rajhi Investment has acquired a strategic stake in Jordan-based artificial intelligence Arabic content platform Mawdoo3 for an undisclosed amount.

Founded in 2010 by Mohammad Jaber and Rami Al-Qawasmi, Mawdoo3 specializes in AI technologies and large language models tailored to the Arabic language.

The deal aligns with Naif Al Rajhi Investment’s focus on emerging sectors, while providing the Jordan-based firm with the resources to expand into the Saudi market.

Mawdoo3, which has raised $25 million over three funding rounds – including a $10 million series B in 2019 – is poised to strengthen its regional presence through this partnership.

Geidea expands SoftPos solution to Egypt after success in Saudi Arabia and UAE

Geidea, a prominent Saudi provider of digital payment solutions, is set to launch its SoftPos service in Egypt after successful rollouts in Saudi Arabia and the UAE.

The SoftPos technology enables merchants to accept secure contactless payments via smartphones, eliminating the need for traditional point-of-sale devices.

This expansion is part of Geidea’s strategy to drive digital transformation across the region by enhancing payment efficiency and accessibility for businesses of all sizes.

SoftPos allows merchants to process secure payments directly from smartphones, adhering to global data protection and transaction safety standards, the company explained.

Flat6Labs backs 10 Saudi startups in Riyadh Seed Program cycle

Flat6Labs, a seed and early-stage venture capital firm operating in the MENA region, has invested in 10 Saudi startups as part of its fourth Riyadh Seed Program cycle.

The startups span a variety of sectors, including e-commerce, logistics, Software-as-a-Service, and cybersecurity, and each received $133,000 in funding.

The initiative is supported by the Saudi Venture Capital Co., Jada Fund of Funds, and Riyadh Valley Company, with additional backing from the National Technology Development Program.

Since launching its Riyadh program in 2023, Flat6Labs has funded 41 startups, solidifying its role in fostering innovation in Saudi Arabia’s entrepreneurial ecosystem.

Sylndr secures $7.46m to boost Egypt’s used car marketplace

Egypt-based used car marketplace Sylndr has raised $7.46 million in a capital facility to support its operations and growth.

EFG Hermes acted as the sole financial advisor for the transaction, with financing provided by EFG Corp-Solutions, Bank NXT, and EG Bank, among others.

Founded in 2021 by Amr Mazen and Omar El-Defrawy, Sylndr enables users to buy and sell used cars while offering financing solutions.

The new capital will be used to enhance customer experience, diversify inventory, and expand financing options. This follows a $12.6 million pre-seed round in 2022, led by RAED Ventures and Algebra Ventures.

Morocco’s PTS raises $500k to scale fintech solutions

Premium Technology & Services, a Morocco-based fintech startup, has secured $500,000 from BMCE Capital Investments, the private equity arm of BMCE Capital Group.

The funding will be used to advance PTS’s solutions for digitizing traditional banking cards, which are tailored to meet the evolving needs of banks and businesses.

Founded in 2020 by Samir Younes and two others, PTS plans to leverage the investment to drive innovation and scale operations to meet increasing demand in the region.

Watercycle Technologies raises $5.6m to advance MENA expansion

UK-based climate tech company Watercycle Technologies has closed a $5.6 million series A investment round led by Par Equity, alongside participation from Aer Ventures, Greater Manchester Combined Authority, and the University of Manchester Innovation Factory.

Founded in 2020 by Ahmed Abdelkarim and Sebastian Leaper, Watercycle Technologies focuses on sustainable critical mineral recovery while producing clean, drinkable water.

This investment will help the company expand its operations, with plans to extend services into the MENA region to support global Net Zero initiatives.

Iraq-based edtech Eduba acquired by a regional telecom giant

Eduba, an Iraq-based education tech startup, has been acquired by an undisclosed telecommunications conglomerate in a seven-figure deal.

Founded in 2019 by Azad Hassan, Haider Shaaban, and Raed Kadhem, Eduba began as a school management app and gained traction among private schools, securing accreditation from Iraq’s Ministry of Education.

This acquisition highlights the growing value of edtech solutions in the region and positions Eduba for further expansion under its new ownership.

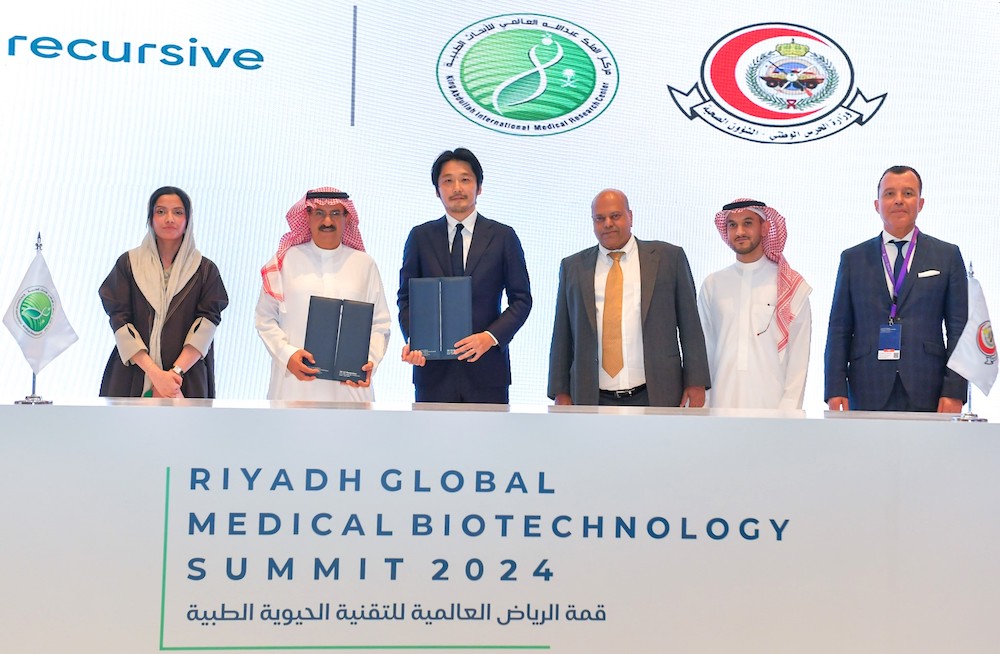

Japan’s AI startup Recursive Inc. inks MoU with Saudi Arabia’s KAIMRC

Japan-based AI startup Recursive Inc. has signed a memorandum of understanding with the King Abdullah International Medical Research Center in Saudi Arabia to jointly develop an advanced system for the early detection of tuberculosis.

The partnership, formalized during the Riyadh Global Medical Biotechnology Summit, aims to leverage Recursive’s AI expertise and KAIMRC’s medical research capabilities to improve TB screening accuracy and diagnosis speed in the Kingdom.

This collaboration, supported by the Ministry of National Guard-Health Affairs, aligns with Saudi Arabia’s Vision 2030 goals to transform its healthcare system and improve public health.

Using chest X-ray imaging data, the AI solution will enable timely TB diagnosis and treatment, reducing mortality and transmission risks.

“We are truly honored to partner with KAIMRC on this groundbreaking initiative,” said Tiago Ramalho, CEO of Recursive Inc.

“By combining KAIMRC’s pioneering medical research with our AI expertise, we are confident we can make a meaningful impact, not only in Saudi Arabia but also in regions worldwide that face the increasing challenge of TB and other infectious diseases,” he added.

The initiative also supports Saudi Arabia’s National Tuberculosis Program, which seeks to reduce TB mortality and incidence rates by 95 percent and 90 percent, respectively, by 2035 compared to 2015 levels.

Through this collaboration, Recursive and KAIMRC aim to create a scalable TB screening model for broader application in high-burden regions while exploring the use of AI to address other infectious diseases.