RIYADH: Saudi Arabia’s Public Investment Fund continues to play a key role in the Kingdom’s economic transformation, leading efforts to diversify revenue streams and reduce reliance on oil.

With assets under management reaching $925 billion, PIF ranks among the world’s most influential sovereign wealth funds, driving investments in technology, infrastructure, sustainability, and culture throughout 2024.

The non-oil sector now contributes 52 percent to Saudi Arabia’s gross domestic product, reflecting the success of Vision 2030, the Kingdom’s ambitious plan to create a sustainable and diversified economy. Central to this progress, PIF has expanded its reach both domestically and internationally, with landmark initiatives designed to reshape industries and enhance the Kingdom’s global competitiveness.

PIF’s tech ventures

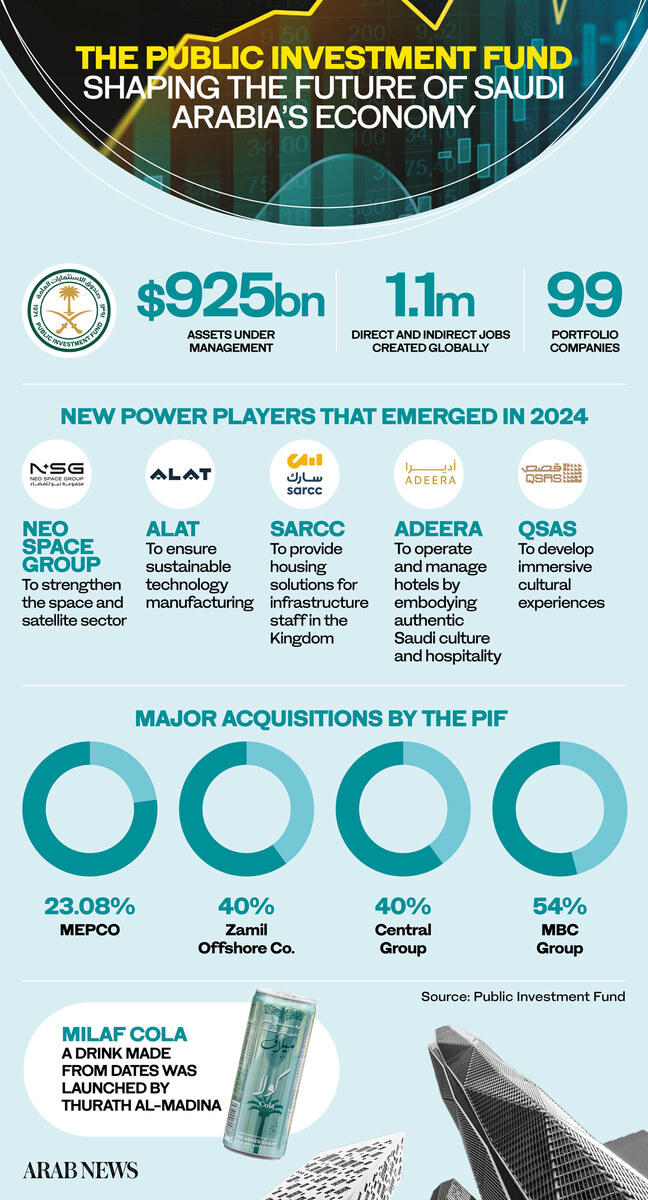

In February, the fund launched Alat, a company dedicated to making Saudi Arabia a global hub for sustainable technology manufacturing. Alat’s partnership with Lenovo Group in May underscored this vision, with the two entities committing $2 billion through zero-coupon convertible bonds.

The collaboration will establish a regional headquarters in Riyadh for the Middle East and Africa, alongside a new manufacturing hub to support Lenovo’s global operations. By June, Alat had expanded its focus with two new business units in electrification and artificial intelligence infrastructure, aimed at meeting the soaring demand for renewable energy technologies and AI-driven solutions.

The electrification initiative is geared toward strengthening grid technology, addressing the increasing energy needs driven by renewables like solar, wind, and hydrogen. Simultaneously, the AI infrastructure segment is set to position Saudi Arabia as a manufacturing powerhouse, leveraging advanced capabilities to cater to global industries.

Space industry leap

Another major milestone came in May when PIF launched Neo Space Group, a company designed to advance Saudi Arabia’s presence in the commercial satellite and space industry.

Neo Space Group announced its focus on satellite communications, earth observation, remote sensing, and navigation technologies, along with a venture capital fund targeting space-focused startups.

“NSG will contribute to the development and deployment of the latest cutting-edge technologies in the space industry through its four dedicated business segments: satellite communications, earth observation and remote sensing, satellite navigation and Internet of Things, as well as a satellite and space-focused venture capital fund,” said PIF.

In December, Neo Space Group made headlines with its acquisition of UP42, a geospatial platform developed by Airbus. This acquisition is expected to significantly enhance Saudi Arabia’s geospatial capabilities, enabling applications across agriculture, infrastructure monitoring, and more, aligning with the Kingdom’s Vision 2030 goals.

Cultural heritage projects

PIF’s activities in 2024 were not limited to cutting-edge technologies. In September, it launched National Interactive Entertainment Co., known as QSAS, which is focused on creating immersive storytelling experiences rooted in Saudi heritage and Islamic culture.

The initiative reflects Saudi Arabia’s broader efforts to balance cultural preservation with business development. QSAS plans to develop and operate interactive exhibitions across the Kingdom while fostering partnerships in construction, event management, and technology.

AI and ICT expansion

The fund also made a major push in artificial intelligence this year. In October, it signed a landmark partnership with Google Cloud to establish an advanced AI hub near Dammam. The agreement, inked during the Future Investment Initiative, is projected to create thousands of jobs and generate $71 billion in economic impact over the next eight years.

Beyond economic benefits, the hub will offer AI training to millions of students and professionals, contributing to national goals of expanding the information and communication technology sector by 50 percent.

Infrastructure investments

Housing infrastructure also came into focus, with the October launch of Smart Accommodation for Residential Complexes Co., or SAARC. This company aims to address the rising demand for workforce housing tied to Saudi Arabia’s large-scale infrastructure projects. SAARC plans to develop residential complexes that adhere to international standards, creating modern living spaces that support the country’s rapid urbanization.

PIF expanded its global investment footprint with a memorandum of understanding signed with Brookfield Asset Management in October. The deal positions PIF as a strategic anchor investor in Brookfield Middle East Partners, a $2 billion fund targeting key sectors such as industrials, health care, and technology. The partnership underscores PIF’s strategy of leveraging international opportunities to strengthen Saudi Arabia’s economic base.

Tourism and hospitality growth

In the hospitality sector, PIF introduced Adeera in December, a new company tasked with operating and managing hotels that combine world-class standards with authentic Saudi hospitality. Adeera is expected to work closely with local developers, fostering private-sector participation and supporting the growth of homegrown brands as Saudi Arabia positions itself as a premier global tourism destination.

Sustainability and innovation took center stage with the December launch of Milaf Cola by PIF subsidiary Thurath Al-Madina. Unlike conventional soft drinks, Milaf Cola is crafted from Saudi dates, eliminating added sugars and emphasizing natural, nutrient-rich ingredients. Introduced during the Riyadh Date Festival, the drink represents PIF’s focus on creating value-added products from local resources while adhering to global food safety standards.

Strategic acquisitions

Throughout the year, PIF pursued an aggressive acquisition strategy, bolstering its portfolio with high-profile deals.

In January, the fund increased its stake in Middle East Paper Co. to 23.08 percent, enabling the company to expand production and enhance operational efficiency.

February saw PIF acquiring a 40 percent stake in Zamil Offshore Co., a key player in the Kingdom’s energy sector.

October marked another milestone as PIF purchased a 40 percent stake in Central Group, a Thai conglomerate interested in retail, real estate, and hospitality.

Rounding the year, PIF announced plans in November to acquire a 54 percent stake in MBC Group for $1.99 billion, solidifying its influence in the entertainment industry.

PIF’s investments in 2024 reflect its multi-pronged approach to transforming Saudi Arabia’s economy. The fund has played a pivotal role in advancing Vision 2030’s objectives, from technology and space exploration to cultural preservation and hospitality. With a focus on sustainability, innovation, and global partnerships, PIF is laying the foundation for a diversified, resilient economy that can compete on the world stage.

As the Kingdom prepares for the next phase of its transformation, PIF’s initiatives in 2024 serve as a testament to its commitment to redefining Saudi Arabia’s economic landscape.