On International Day of the Arabian Leopard, together, we can make a difference

https://arab.news/9ckzy

Wildlife conservation is critical to the planet’s biodiversity and to ensuring the long-term survival of countless species … including our own. While the plight of an animal like the Arabian leopard may seem far removed from the daily life of most, our collective well-being is inextricably linked. Everything in nature is connected to the rest of the world. Your health and the health of your family and community is linked to the vitality of all other species.

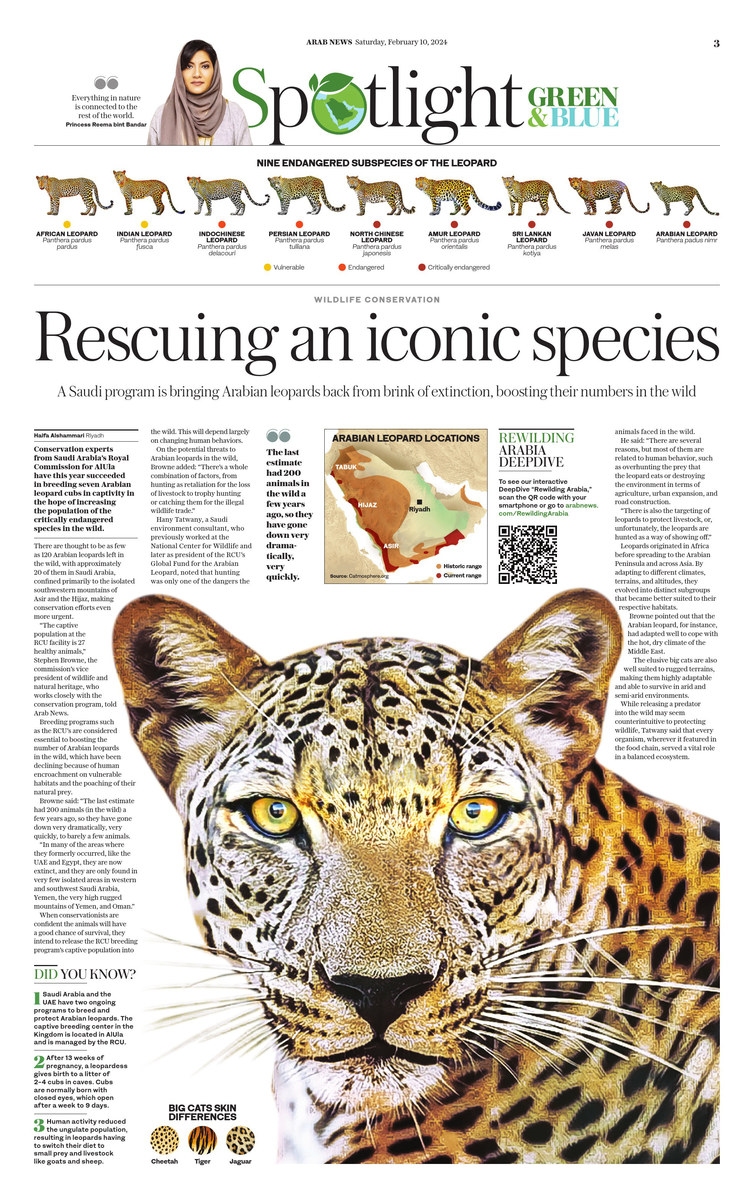

In 2021, with fewer than 200 Arabian leopards — a critically endangered species — left in the wild, I started Catmosphere. In the midst of the COVID-19 pandemic, it became increasingly clear how our planet, environment, wildlife and our own well-being are all interconnected. And while the survival and longevity of this subspecies may have driven the original initiative, the story is one of determination and hope for our collective future.

As human activities continue to encroach on natural habitats and drive species like the Arabian leopard to the brink of extinction, the need for conservation efforts has never been more urgent. Among the many species threatened by habitat loss, poaching and human-wildlife conflict, big cats stand out as iconic and imperiled symbols of the challenges facing wildlife conservation. And the Kingdom of Saudi Arabia is leading efforts to help ensure their survival. Whether through the Catwalk Trails in Sharaan Nature Reserve, the Royal Commission for AlUla’s breeding and reintroduction program or the Arabian Leopard Fund, the Kingdom is committed to fostering a more sustainable future, including for wildlife.

While the survival and longevity of this subspecies may have driven the original initiative, the story is one of determination and hope for our collective future.

Princess Reema Bandar Al-Saud

Catmosphere has worked with leading experts in the field of conservation to tell the stories of big cats and their conservation challenges to encourage us all to take action to address our collective well-being. The preservation of big cats, including species such as tigers, lions, leopards, jaguars and cheetahs, has been the focal point of Catmosphere’s global efforts to protect biodiversity. These majestic creatures play a vital role in maintaining the ecological balance of their respective habitats. As apex predators, big cats help regulate prey populations, which in turn affects the entire food web. However, big cats face numerous threats that jeopardize their survival, including habitat destruction, the illegal wildlife trade and climate change.

So, I was so elated that, through Catmosphere’s efforts, the UN last year recognized the “International Day of the Arabian Leopard,” an initiative sponsored by Saudi Arabia and co-sponsored by more than 30 member states. The resolution proclaimed Feb. 10 as the International Day of the Arabian Leopard, to be observed annually around the world from this year. This announcement was significant because it was the first time ever that the UN had named an international day of recognition for a mammal or a big cat or a subspecies. And it was the first time that an international day established by the UN was led by Saudi Arabia. I am particularly proud that this day is for conservation.

On the first International Day of the Arabian Leopard, Catmosphere is inviting everyone to celebrate by taking part in the third “CATWALK,” a mass participation walk that is open to everyone, everywhere. The Arabian leopard and its habitats cannot speak for themselves. We need to speak and act on their behalf. I encourage you to visit the Catmosphere website (catmosphere.org), where you can get involved, participate in the CATWALK and register your support.

This first International Day of the Arabian Leopard is a testament to the idea that truly anything is possible … it is not too late. Our well-being is interconnected — from reintroducing the native Arabian leopard in AlUla to planting mangroves in the Red Sea, our collective action brings positive change. Together, we can make a difference.

• Princess Reema Bandar Al-Saud has served as the Ambassador of the Kingdom of Saudi Arabia to the US since 2019. She founded Catmosphere, a foundation aimed at addressing collective well-being through conservation, in 2021.